Contents

The USD is the abbreviation for the U.S. dollar, the official currency of the United States of America and the world’s primary reserve currency. The ratio is more powerful the greater the percentage above the 50% mark, such that if longs are showing up as 70% then that means that the crowd is extremely bullish and more likely to be wrong. It is also worth mentioning that some currencies tend to move in the same direction, while others move in the opposite direction.

Open positions can be held from minutes to years depending on the style and objective of the investor or trader. When you close a buy position, you sell the asset at the current market price. When you close a sell position, you buy the asset at the current price. If the scenario turns in the right direction, some traders prefer to set the stop loss, going in the price movement course to reduce the trade’s market exposure. When the position is closed by a stop loss, it means that the trade is exited automatically.

Whether for equities, bonds, Forex, rates, or commodities, it is important to focus on trading products directly, avoiding leveraged derivatives, except for ETFs and Futures contracts without leverage . Derivative products like CFDs are complex instruments and often too expensive in terms of fees over the long term. However, they can be used occasionally, with options, to hedge a position or the entire portfolio in special situations. OANDA Corporation ULC accounts are available to anyone with a Canadian bank account.

In general, the best bet is to close your position once you feel your technical indicators and trading strategy are no longer relevant to the position’s current price or patterns. This is the most important step for determining forex position size. Set a percentage or dollar amount limit you’ll risk on each trade. For example, if you have a $10,000 trading account, you could risk $100 per trade if you use the1% limit. Your dollar limit will always be determined by your account size and the maximum percentage you determine.

Trending

If they don’t, they hold on to their risky position overnight or longer during which time the market could turn against them. In this article, we explain what an open position entails in stock and currency pairs trading. Also, we will see what markets and financial instruments are most appropriate for an open position strategy. Finally, we examine the advantages and risks of open positions trading style. For example, an investor who owns 500 shares of a certain stock is said to have an open position in that stock.

This part of the OANDA Sentiment Dashboard allows traders to monitor upcoming events and see how a variety of instruments have previously traded at current sentiment levels. Analyse the forex sentiment and the emotions of retail investors; the net amount of optimism, or pessimism, reflected in any asset’s performance. If you are new to forex trading, we recommend downloading avatrade review our free forex for beginner’s guide which takes you through the fundamental steps to getting started. It is also important to understand the number one mistake traders make when trading forex. Information is provided “as is” and solely for informational purposes, not for trading purposes or advice. To see all exchange delays and terms of use, please see disclaimer.

These ratios are great ways to get a grasp which currency pair holds the most liquidity, which currency pair is the most active, and can provide signals of a trend reversal. Spot trades only represent a small percentage of foreign transactions, and retail trading platforms are only a small percentage of that. If open position ratios have any use, it is to show which retail trades have become crowded, and this might simply reflect herd behavior.

An open position means that a trader has a trade whose financial result has not been recorded. Closing a position is a situation when the opposing trade has already been completed, and the financial result is recorded on the trader’s balance. The easiest way to close Forex open positions is exiting by market, i.e., you manually exit the order by the market price at the present moment. According to a close position meaning, you must accordingly buy the same amount of the asset to exit a sell order. A closed position is a situation when the financial result of the opened position is fixed.

In trading, a position refers to the number of financial assets purchased or sold short by an investor. They usually buy when an uptrend is anticipated and sell short when they expect a downtrend. It is also known as open interest in the futures and options market.

Further reading to support your forex trading

She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. The strength of the bullish or bearish signal is dependent on the percentile degree above or below the 50% mark, along with the percentage change from last report. A long position is an executed trade where the trader expects the underlying instrument to appreciate. For example, when a trader executes a buy order, they hold a long position in the underlying instrument they bought i.e. Here they are expecting the US Dollar to appreciate against the Japanese Yen.

- Therefore, if I close the position right now, the yield will be negative, shown in the ‘Profit’ section.

- However, it can be seen that the net open position has certain limitations, which need to be included in the analysis too.

- Forex sentiment indicators can help your trading, especially if you’re a forex swing trader or decided to be a longer-term forex trader.

- Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

- For new traders, in particular, this protects them from making questionable judgment calls prompted by anxiety or other factors.

And after that, Litecoin is bought, selling Bitcoin, which will be the LTCBTC pair’s purchase. The bigger the trade volume , the more money you need to open a position; it is a market axiom. This is due to the difference in prices at which other market participants are willing to buy or sell an asset. To set a buy limit order, you need the entry parameter ‘at the price’ and set the required price.

Keep reading to find out more about long and short positions in forex trading and when to use them. People who trade on long-term timelines are opening positions with the expectation of long-term price trends coming to pass. Instead, they’re making trades based on macro trends and information.

Set Your Account Risk Limit Per Trade

You can close your positions on the same trading day, in swing trading or intraday trading. Or you can hold positions open for a few days or even weeks, as in long-term trading. A trader’s portfolio is a collection of open positions held by the trader. It stays open until an opposing trade is executed to close it, and the risk exists until the position is closed. Any market movements would directly influence the holdings or the position.

Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost. Learn how to trade forex in a fun and easy-to-understand format. There are markets whose characteristics are particularly interesting for the practice of Position trading.

What is an open position in forex trading?

An advantage of the forex market is that it trades virtually 24/5. Some traders prefer to trade during the major trading sessions like the New York session, London session and sometimes the Sydney and Tokyo session because there is more liquidity. DailyFX features IG client sentiment for a full overview of what positions traders are taking in the forex market.

A stop-loss works out if the price goes in the opposite direction to the forecast. The financial result of trades is always calculated only after the position is closed. To close a buy position, you need to enter a sell trade of the same volume. For example, if you opened a buy position with a volume of 0.1 lots, then to close it, you will also need to sell 0.1 lots.

If you’re worried about timing your trading activity right, it’s often helpful to establish a strategy and rules for closing positions prior to executing a trade. For new traders, in particular, this protects them from making questionable judgment calls prompted by anxiety or other factors. Swing traders might choose to place a stop loss and take profit order and cut a position when then market breaks against them instead of being concerned with the length of time they hold a position. Most scalpers are looking to open and close positions within a few minutes, and almost always within a half-hour to an hour.

IG Client Sentiment

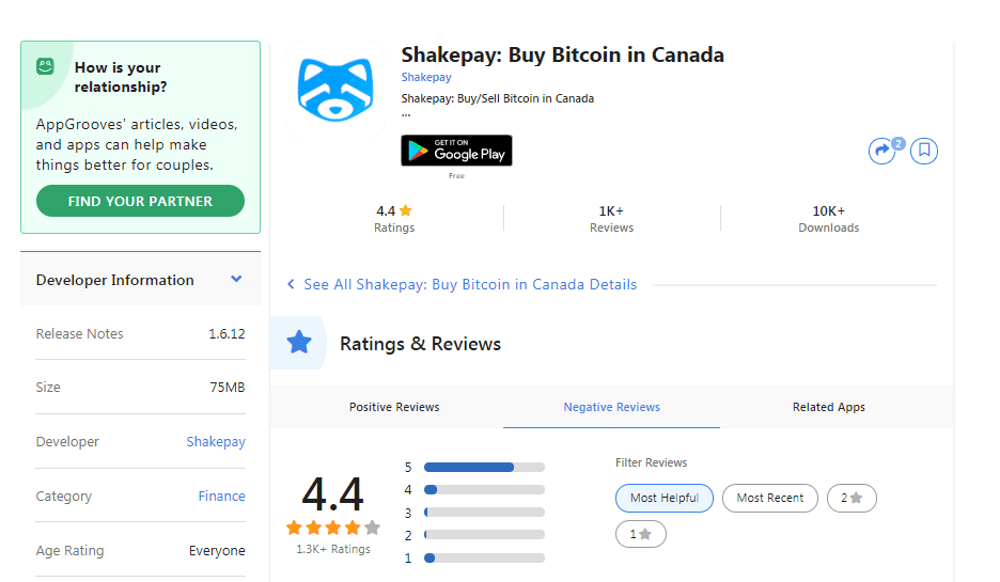

This simply means that EUR/USD represents 25.8% of all open positions at FutureForex at that time. The open position ratio indicates the proportion of open currency positions held on a given forex trading platform. Leveraged trading in aafx trading review foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Major pairs are the most traded foreign exchange currency pairs. There are four major pairs based on the USD, EUR, JPY, GBP, and CHF. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Open position trading can be a great trading style for a trader who can’t track trades all day or doesn’t want to be under too much stress. It is also very suitable for investors fond of fundamental and financial analysis. The stock market typically accounts for the largest proportion of positions taken coinbase exchange review by position traders. It is also possible to take an interest in the Forex market (strong medium-term trends) but with low or even zero leverage. As an example, the currency pair of euros vs. U.S. dollars (EUR/USD) may have an open position ratio of 25.8 on the hypothetical FutureForex platform.